- BY John Vassiliou

What you need to know before buying a property in the United Kingdom

Page contents

- Purchasing a property in England & Wales

- Purchasing a property in Scotland

- What tax will I pay if I purchase a residential property?

- Will I need to pay more tax if I purchase a property while being considered as non-resident?

- I already own a home abroad and don’t plan to sell this before moving to the United Kingdom, will this affect how much tax I pay?

- Would it be better to purchase a property using a trust structure or company?

- Do I need a visa to purchase property in the UK?

- Will owning property in the UK help me get a visa?

This is the third of my series of articles where I have enlisted the help of my specialist private wealth and tax colleague Emma Read to explain what some of the legal consequences of moving to the UK may be for people, beyond the need to sort their immigration status. Today we are looking at property purchases.

As a starting point, you do not need to have permission to live in the UK to buy property here. UK property can, typically, be purchased regardless of where the purchaser lives.

England and Wales, Scotland and Northern Ireland all operate different legal systems and have their own unique laws and procedures relating to property. A sensible first step would be instructing a solicitor qualified and practising in the jurisdiction you are looking to buy in.

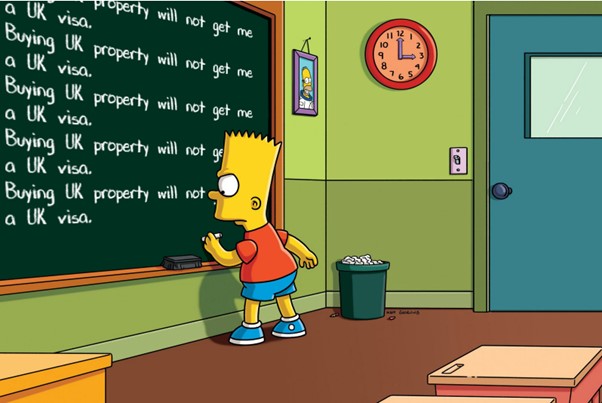

Below is a brief overview of the process in England and Wales and Scotland. Before you go any further though, there is one key thing for you to remember: buying property does not create immigration rights. You can write this in my immigration lawyer’s obituary in years to come, along with ‘if you liked it then you shoulda put a ring on it’.

Purchasing a property in England & Wales

Making an offer

Most people start their property search using online property sites or through local estate agents. An offer to purchase can be made verbally or in writing and at this point you should look to instruct a solicitor. The offer will not be binding until the exchange of written contracts has taken place.

Applying for a mortgage

When applying for a mortgage, you will need to present documents to prove your identity and address and information on our source of funds. A mortgage adviser may help you to find the right mortgage. If you have a time-limited UK immigration status (or if you are not in the UK at all) then you may have difficulty securing a mortgage from a UK lender.

Contract for sale

Once an offer has been accepted, you should instruct a legal professional to carry out the conveyancing work.

Once you and the seller are satisfied with the terms of the sale, the next step is to exchange contracts. This is when the sale becomes legally binding. The completion date is fixed at the point of exchange.

At exchange, the buyer will usually pay a deposit to the seller. The standard amount is 10% of the purchase price, however this is open to negotiation between the parties.

You should arrange buildings insurance from the date of exchange of contracts, as at this point risk in the property will be passed to you from the seller.

If you withdraw from the purchase after exchange of contracts you may lose your deposit and be liable for other losses incurred by the seller.

Completion

Legal completion occurs when the completion funds are sent to the seller and the signed transfer deed, agreed between your conveyancer and the seller, is dated with the date of completion and sent to the seller’s solicitor. Your conveyancer will receive the seller’s signed transfer deed in return.

Post completion – Tax and Registration

If the purchase price of the property is above the relevant threshold, Stamp Duty Land Tax (SDLT) (for properties situated in England) or Land Transaction Tax (for properties in Wales) will be payable to HM Revenue and Customs (or the Welsh Revenue Authority for transactions in Wales) and a return must be submitted within 14 days of the completion date. Further detail on this tax is given below. Penalties and interest will apply if your return is not submitted, and payment made by this deadline.

Your conveyancer will register the transfer (and legal charge if you have used a mortgage to purchase the property) at HM Land Registry.

Purchasing a property in Scotland

Once you have found a property that you are happy with and the home report, as provided by the seller, is acceptable to you, the first step is to ask you solicitor to note interest on your behalf or to make an offer. By noting interest you are under no obligation to proceed, it is simply a means of advising the seller that you are interested in the property and ensuring that you are made aware of other interested parties and closing dates.

Offer and Acceptance

Scotland operates a blind bidding system where sellers will usually ask for ‘offers over’ a minimum price at a closing date and potential purchasers are invited to submit their best offer.

When an official offer is made, it is in writing by your solicitor on your behalf and it is at this stage, when your offer has been verbally accepted, that you should make a full mortgage application, if required.

The offer is formally accepted by way of a qualified acceptance. The seller and purchaser’s solicitors will then negotiate the terms of the transfer via the ‘missives’. These are formal letters making up the contract. Further qualifications will pass between the two sides until the terms of the purchase are agreed.

Concluding Missives

Once missives are concluded both parties are now legally bound to the transfer. Up until this point either party could have walked away from the transaction, but once missives are concluded, attempts to back out of the purchase could result in financial repercussions. Your solicitor will always consult you before concluding missives to obtain your instructions to do so.

Settlement

At date of entry, the purchase price is released to the seller’s solicitors and the keys will be released to you as the purchaser. The transfer is complete and ownership changes.

Your solicitor will then register the disposition (the transfer deed signed by the seller) and the standard security/mortgage (if one is obtained) at the Land Register of Scotland on your behalf.

Land & Buildings Transaction Tax

The final step at settlement is the payment of the Land & Buildings Transaction Tax (LBTT). This is the Scottish version of SDLT and is a tax on land transactions in Scotland.

What tax will I pay if I purchase a residential property?

What type of tax you pay when purchasing a property depends where in the United Kingdom the property is situated.

- In England and Northern Ireland, you will pay Stamp Duty Land Tax – rates here.

- In Wales you will pay Land Transaction Tax – rates here.

- In Scotland you will pay Land and Buildings Transaction Tax – rates here.

Will I need to pay more tax if I purchase a property while being considered as non-resident?

Yes, in most circumstances, non-resident purchasers of property in England or Northern Ireland are required to pay an additional 2% of Stamp Duty Land Tax. The Statutory Residence Test (discussed in our earlier article [link]) is not used to establish ‘residence’ for these purposes and rather residence for these purposes is determined by looking at physical presence in the UK over a 12-month period. In addition if you subsequently become resident within a 365-day period following the purchase, this can be reclaimed.

There is currently no equivalent surcharge for non-residents who purchase property in Scotland or Wales.

I already own a home abroad and don’t plan to sell this before moving to the United Kingdom, will this affect how much tax I pay?

Yes. If you, your spouse or civil partner or a minor child already own a residence (or interest in a residence) anywhere in the world (including if this is let out), you will be charged additional tax.

In England and Northern Ireland the Stamp Duty Land Tax surcharge will apply (3%).

In Scotland, the Additional Dwelling Supplement will apply (6%).

In Wales the higher rates of Land Transaction Tax will apply – these are bespoke rates which vary depending on the purchase price and are available here. If you sell your existing dwelling within a certain period following the purchase, the additional tax may be reclaimed. Time limits apply when making any such reclaim.

Would it be better to purchase a property using a trust structure or company?

Purchasing a property using a company or trust structure is unlikely to result in any meaningful tax savings and in many cases will lead to additional tax exposure. This is because there are further taxes which apply when purchasing a property in this way, including additional rates of Stamp Duty Land Tax, the Annual Tax on Enveloped Dwellings and, potentially, inheritance tax.

When it comes to selling a property, if this is held in a trust structure or by a company there may also be higher tax to pay on sale. If there is a capital gain crystallised on a sale, certain reliefs which would otherwise be available to individuals (such as principal private residence relief) will not be available when selling through a company structure. There may also be ongoing inheritance tax compliance requirements which need to be met if a property is purchased through a trust structure.

Specific advice should be taken if you are considering purchasing a property in this way.

Do I need a visa to purchase property in the UK?

No.

Will owning property in the UK help me get a visa?

No.

SHARE