- BY Pip Hague

How to apply for a Global Business Mobility: Service Supplier visa

THANKS FOR READING

Older content is locked

A great deal of time and effort goes into producing the information on Free Movement, become a member of Free Movement to get unlimited access to all articles, and much, much more

TAKE FREE MOVEMENT FURTHER

By becoming a member of Free Movement, you not only support the hard-work that goes into maintaining the website, but get access to premium features;

- Single login for personal use

- FREE downloads of Free Movement ebooks

- Access to all Free Movement blog content

- Access to all our online training materials

- Access to our busy forums

- Downloadable CPD certificates

Table of Contents

ToggleThe Global Business Mobility: Service Supplier route is for overseas workers who are undertaking temporary assignments in the UK. The applicant must be either a contractual service supplier employed by an overseas service provider or a self-employed independent professional based overseas. The service performed must be covered by one of the UK’s international trade agreements.

The Service Supplier route was previously part of the Appendix Temporary Worker: International Agreement route (known as the ‘International Agreement’ visa). The International Agreement visa still exists for a person who wants to come to the UK to provide a service covered under international law, but it is now limited to private servants in diplomatic households, or employees of overseas governments and international organisations. The service supplier element has been carved out and grouped together with four other temporary work visas under the Global Business Mobility routes. You can find them in the immigration rules under Appendix Global Business Mobility.

Dependent family members can apply to come to the UK in this route, but it does not lead to settlement.

Note: in the rules and guidance, the words ‘overseas service supplier’ and ‘contractual service supplier’ are used interchangeably.

What is a service supplier and why is this route useful?

A service supplier is a company who supplies services in a specific sector under a specific international agreement listed in Table A of the sponsor guidance. The company must not have a commercial presence in the UK (which means they mustn’t have an office, branch or subsidiary in the UK).

The service supplier is completely disconnected from the UK and yet, to use this immigration route, they need a UK sponsor. You might ask yourself, why would a UK company want to bother taking on onerous sponsorship duties and sponsoring someone else’s employees to come to the UK?

Before Brexit, the EU was a major recruitment pool for UK businesses, particularly when it came to tradespeople. That pool has slowly dried up since the end of free movement, contributing to labour shortages. This route is useful because it allows UK companies to temporarily fill the skills gap and maintain business continuity.

Although there is no English language requirement, the route has strict eligibility requirements. It’s a last resort if there are no other immigration routes available to get tradespeople over to the UK. Because of how strict the route is, independent professionals tend not to get involved, so we’ll focus on contractual service suppliers throughout this guide.

British Engineering Ltd use several turbines that are in constant operation on their site in Grimsby. Once a year the turbines are tested and any damage is repaired. To do this, the site is completely shut down for 4 weeks.

Before Brexit, British Engineering Ltd would hire several employees from Best Turbines GmbH in Germany, who would come to the UK to do the work during the shutdown period.

After Brexit, Best Turbines GmbH tried to identify any employees who already had the right to work in the UK without success. They looked at the Skilled Worker route, but only two employees spoke English well enough and setting up a UK entity to hold the sponsor licence was not an economically viable option. The Senior or Specialist Worker route is not an option because Best Turbines GmbH and British Engineering Ltd are not linked by common ownership and control. They also briefly considered bringing the workers in using paragraph PA7 of Appendix Visitor: Permitted Activities which allows for the manufacture and supply of goods (and services) in specific circumstances, but after consulting with the Home Office, they decided it did not apply.

British Engineering Ltd cannot see any other workaround, so to facilitate this work, they apply for and are granted a Global Business Mobility: Service Supplier sponsor licence. They plan to use the Service Supplier route to sponsor employees from Best Turbines GmbH and submit details of the contract with the licence application.

Applying for a visa in this route in advance provides British Engineering Ltd with certainty in knowing they have secured the supply of labour. It provides British Engineering Ltd with reassurance that the work will be done within the 4-week shutdown period. Imagine if they risked using PA7 and the workers were refused entry at the border? Not having this certainty could result in costly consequences such as extending the shutdown period, postponing the return to work of their resident workforce, reducing productivity and a loss of revenue.

Requirements for the UK sponsor

There are requirements for the UK sponsor, the overseas service supplier and for the visa applicant. Let’s start with the UK sponsor.

Having a licence

The UK sponsor must have an A-rated, Global Business Mobility: Service Supplier sponsor licence. Applying for a sponsor licence is beyond the scope of this article, but there is detailed guidance on the Home Office website.

Having a qualifying overseas business link and an eligible contract approved by the Home Office

The service supplied must be in line with a genuine contract for a period not exceeding 12 months. The contract must have been awarded through an open tendering procedure (or any other procedure which guarantees that the contract is genuine).

The service supplier provisions under the Global Business Mobility route now allow the overseas service provider to sub-contract provided there is a clear contractual link between the sponsor, the sub-contractor and the overseas service provider. This widens the potential talent pool for the overseas service provider and benefits the sponsor in turn. Be mindful at the outset that the sub-contractor may need to be listed on the main contract or addendums and in the list of personnel. There may be additional documents to include when obtaining contract approval from the Home Office.

When applying for a sponsor licence, the sponsor will submit evidence of the contract with the licence application. Once the licence is approved, a sponsor can only assign Certificates of Sponsorship (‘CoS’) to workers who are working under that specific contract. This means that if a sponsor wants to assign subsequent CoS to workers from another overseas business, they must submit a new contract to the Home Office and await approval. Each contract must be approved before CoS can be assigned. The Home Office take this requirement very seriously and will revoke the sponsor licence if the sponsor does not comply.

To submit a new contract, sponsors must use the ‘Request change of circumstances function’ in their SMS account and request an increase in CoS allocation. The Home Office must approve the contract and the allocation before the sponsor can assign a CoS. The Home Office take this requirement very seriously. They will revoke the sponsor licence if the sponsor assigns a CoS in connection with a contract that hasn’t been submitted or that has been submitted but has not yet been approved or that the Home Office has said doesn’t meet the requirements.

You should be able to view approved contracts on the Sponsor Management System (‘SMS’). SMS Guide 11 explains how to do this but in short, select ‘Licence summary, applications and services’ and ‘Overseas Linked Entities’. There is section for service suppliers, where you can see:

- Name of linked OSE

- Contract name

- Contract purpose

- Contract effect from/to dates

- Related trade agreement

- Applicable sector

If you assign a CoS in relation to any other contract that has not been approved, the sponsor licence will be revoked. More on assigning a CoS below.

Being the final consumer of the service

Sponsoring contractual service suppliers and then supplying them to another organisation is prohibited. The UK sponsor must be the final consumer of the service.

Assigning a valid Certificate of Sponsorship

Failure to draft and assign the CoS correctly is very likely to result in a refusal. There are a few key differences compared to a Skilled Worker and Senior or Specialist Worker CoS, explained below.

- An undefined CoS is required for entry-clearance applications.

- The role summary should specifically state that they are being sponsored on the Service Supplier route and as a contractual service supplier.

- Select a suitable SOC Code (more on this below).

- If the UK sponsor is not paying the salary, this must be entered as £0.01 and details of the payment arrangements must be explained in the free text box below the salary field.

- You must provide the details of the specific, eligible international agreement and the name and duration of the contract.

- Maintenance is usually certified on the CoS, primarily to keep the list of supporting documents to a minimum.

Requirements for the overseas service supplier

The work must fall within the scope of commitments in a specified international agreement

The caseworker guidance explains that a service can only be covered by a trade commitment when the relevant agreement is in force or provisionally applied. It contains a link to eligible trade agreements. You can cross-check with the sponsor guidance which also has a list in Annex GBM1. Examples of eligible international agreements include General Agreement on Trade in Services (GATS) and the EU-UK Trade and Cooperation Agreement.

The overseas service supplier must agree with the UK sponsor that the work the visa applicant is coming to perform falls within the scope of the sectors specified in the agreements mentioned in Table A, which you’ll find underneath the list of international agreements.

They must be established in the country or territory of that is signatory to the agreement

The contractual service supplier must also be established in the country or territory that is a signatory to the agreement under which they are supplying services. This means they must be registered as a trading company. The country or territory (and the UK) must have signed the international agreement that is being relied upon.

No commercial presence in the UK

As mentioned, the overseas service supplier must not have a commercial presence in the UK.

Requirements for the temporary worker

The worker must meet the validity, suitability and eligibility requirements. We’ll do a quick tour through the validity and suitability requirements first, then focus on the detail under the eligibility requirements.

Validity requirement

The validity requirements are similar to the requirements for most PBS routes under the new immigration system. The applicant must submit a valid visa application and pay the required application fee, Immigration Health Surcharge (if applicable), enrol their biometrics, submit their documents and have an assigned Certificate of Sponsorship issued no more than 3 months before the date of application. Those who are eligible to do so can apply using the UK Immigration: ID check app.

You can switch into this route provided you were not last here on a short-term visa such as a visitor, seasonal worker or short-term student. You previously couldn’t switch unless the applicant was applying for permission to stay and they were already here with permission under the route, so this is a welcomed improvement.

Suitability requirement

The applicant must not fall for refusal under the grounds for refusal in Part 9 of the Immigration Rules. If applying for permission to stay, they mustn’t be in breach of immigration laws except for the usual paragraph 39E (which contains exceptions for overstayers) and they must not be on immigration bail.

Nationality and residence requirements

The visa applicant must be a national of the country or territory in which the overseas undertaking is established.

There are also specific rules applicable depending on which international agreement is replied upon. The most useful to know, is that those with permanent residence in a country or territory that have made a notification under General Agreement on Trade in Services (GATS) can also apply. It’s not specifically stated in the sponsor guidance, but in principle, this is possible under any of the international agreements provided you get some kind of assurance from the Home Office first (such as confirmation from the Sponsor Change of Circumstances team, see below).

Overseas work requirement

The applicant can be a current employee working for the overseas service supplier and must have worked as or for the overseas service provider outside the UK for a cumulative period of 12 months.

They must submit payslips to evidence their employment history and, if these are issued electronically, a payslip authentication letter on letter headed paper. There is an option to submit bank statements showing the salary going into the account, but if payslips can’t be supplied, you need to double-check why this is. You don’t want to suddenly realise they are a sub-contractor or self-employed worker at the last minute as there are separate requirements for them.

Qualification requirement

The applicant can meet the qualification requirement through either Option A or Option B.

Paragraphs SSU 6.1 to 6.6. set out the requirements for Option A. The applicant must be sponsored in a role from Appendix Skilled Occupations that is eligible for the Global Business Mobility routes. SSU 6.2 and 6.3 warn the sponsor that they must select an appropriate code and shouldn’t choose a less appropriate code because it comes with a lower salary requirement. The sponsor is informed that they could be subject to scrutiny by the decision-maker who may consider whether there is a genuine need for the role, the applicant’s skill level and the sponsor’s previous track record of compliance.

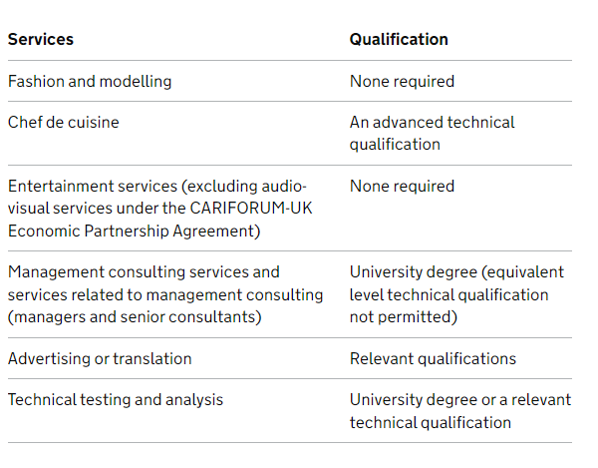

Paragraphs SSU 7.1 to 7.5 set out the requirements for Option B. The applicant can apply if they have a university degree or equivalent level technical qualification unless an exception applies. The are only 6 exceptions listed.

The most useful of these that I’ve come across is for those who are working in the sector of ‘technical testing and analysis’. The qualification in these circumstances is either a ‘university degree or a relevant technical qualification’ rather than equivalent technical qualification. The latter can usually be a qualification from City and Guilds or similar. Given the time-sensitivity and high risk associated with this route, it is worth using ECCTIS to obtain a statement of comparability to confirm.

Additionally, the applicant must have at least 3 years of professional experience in the sector (or more in certain circumstances). The applicant will demonstrate that they meet the requirement by submitting a CV listing their employment history. They can also include references. They must also declare that they meet this requirement on the application form.

Lastly, the applicant must hold any professional qualifications or registrations required to provide the services under UK law, regulations or sectoral requirements. Although this rule isn’t specified for those applying under Option A as a requirement, you may wish to advise the sponsor to check that each applicant has all the qualifications and registrations necessary so that they can comply with wider UK law.

Best Turbines GmbH decide to bring Markus, Bram and Kat to the UK to test the efficiency of the turbines and repair them where needed for British Engineering Ltd. The work will take place in December 2023. They are all German nationals. Markus will be working as a quality and control engineer. Bram and Kat will be performing metal plate work repairs.

Markus is eligible to apply under SOC Code 2461 Quality control and planning engineers. He studied engineering at university and will submit his degree certificate. Markus meets the requirements under Option A.

Bram did an apprenticeship and qualified while working with Best Turbines GmbH over 4 years ago. Kat is following the same learning pathway as Bram and is currently an apprentice.

There is a question mark over the level of Bram’s qualification and Best Turbines GmbH decide to send his certificates to ECCTIS. Depending on the outcome, he may meet the requirements under Option B. Kat will not meet the requirement as an apprentice.

Bram has a full list of the UK’s professional qualifications and registrations required, but his ‘confined space’ and ‘working at height’ certificates expire in November 2023. He needs to renew these to ensure they are valid during December 2023.

Genuineness requirement

Finally, the applicant must genuinely intend to perform the role they are being sponsored to do.

When this route is all about securing certainty of a supply of labour to the UK sponsor, the last thing you want is a genuineness requirement. The Home Office can subjectively assess the entire application, request more documents, ask questions and cause delays.

Because of this, it’s wise to prepare months in advance to gather all the required evidence (while heeding the time-sensitive documentary requirements of course). In practice, the UK sponsor is likely to have started the process a year or so before. They will have submitted the tender and sourced the potential overseas service supplier.

How much does it cost?

It’s comparatively cheap. There is no Immigration Skills Charge, which is a relief to sponsors. If the worker is applying for entry-clearance for a period of less than 6 months, they will also be exempt from the Immigration Health Surcharge.

For an entry-clearance application for a duration of less than 6 months, fees are currently as follows:

- Application fee: £259

- Certificate of Sponsorship: £21

- Any priority processing fees: Approx. £250

Note that there has been a recent announcement reporting a hike in immigration fees. Look out for updates on Free Movement.

What will I get if my visa is approved?

Those applying for entry-clearance will get an approval email and a 90-day visa sticker. The worker must travel to the UK before that period is up and will most likely travel to arrive in line with the start date stated on their CoS and as per the UK sponsors timeline for completion of the work.

After arriving, if the length of stay is more than six months, the worker will be issued with a Biometric Residence Permit. Anyone applying using the UK Immigration app will receive digital immigration status instead of a physical permit. It’s rare that service suppliers apply to extend but if they did or if they switched into the route, what they’ll get will usually depend on their nationality and whether they had a BRP before.

The UK sponsor should complete a right to work check before the worker’s first day of employment as stated on their Certificate of Sponsorship.

How long can a visa be granted for?

The visa should be issued to align with the job duration. The total duration is generally limited to up to 6 months or 12 months depending on the trade agreement. Service Suppliers can return to the UK for further assignments, but the maximum length of assignments must not lead to the applicant being granted cumulative periods of permission on the Global Business Mobility routes totalling more than 5 years in any 6-year period.

It’s important to check whether the worker has had previous permission on any of the Global Business Mobility routes, as this will determine how long they can be granted for. Workers on Global Business Mobility routes should be reminded that they will only ever have temporary permission to be in the UK, unless they switch into a route that does permit settlement.