- BY Irfan Ali

A guide to civil penalties for illegal working

THANKS FOR READING

Older content is locked

A great deal of time and effort goes into producing the information on Free Movement, become a member of Free Movement to get unlimited access to all articles, and much, much more

TAKE FREE MOVEMENT FURTHER

By becoming a member of Free Movement, you not only support the hard-work that goes into maintaining the website, but get access to premium features;

- Single login for personal use

- FREE downloads of Free Movement ebooks

- Access to all Free Movement blog content

- Access to all our online training materials

- Access to our busy forums

- Downloadable CPD certificates

The government have ramped up its effort to crack down on illegal working, resulting in a surge of enforcement activity throughout England.

We are certainly seeing a rise in the number of civil penalties being issued. The Home Office can apply tough sanctions if it discovers that an employer is employing an individual illegally.

In this guide to civil penalties for illegal working, we look at the steps an employer needs to take to navigate the process, and the options available to them.

What is a civil penalty?

Employers found to be employing individuals who do not have the right to work in the UK risk receiving a civil penalty for each worker. If the employer is found to have known that the individual in question did not have the right to work, they can also face prosecution.

A civil penalty is a fine that can be imposed under Section 15 of the Immigration, Asylum and Nationality Act 2006, which states:

It is contrary to this section to employ an adult subject to immigration control if —

(a) he has not been granted leave to enter or remain in

the United Kingdom, or(b) his leave to enter or remain in the United Kingdom —

(i) is invalid,

(ii) has ceased to have effect (whether by reason of curtailment, revocation, cancellation, passage of time or otherwise), or

(iii) is subject to a condition preventing him from accepting the employment.

Civil penalties are issued by the Home Office once they have discovered that an employer is employing a person who does not have permission to work in the UK.

How are civil penalties administered?

The code of practice on preventing illegal working sets out how the civil penalty is administered by the Home Office.

We have briefly outlined the various steps and stages involved with the process:

Breach

A breach is where the employer is found to be employing a person who is not permitted to work or who is working in breach of their immigration permission.

Referral

An employer may be served with a civil penalty referral notice informing them that they are being referred to Home Office officials for consideration of liability for a civil penalty.

Information request

The Home Office will contact the employer with an information request giving them the opportunity to provide further documents and information. They will usually have ten days to respond to the request. Where a response is provided within the timescales, this is considered as active co-operation with the process, which could result in the level of penalty being reduced.

Decision

Once the case has been reviewed by the Home Office, the employer may receive one of the following notices:

- Civil penalty notice

- Warning notice

- No action notice

A civil penalty notice will be issued where the Home Office believes an employer is liable for a civil penalty for employing one or more individuals who do not have the right to work in the UK or who are working in breach of their conditions of stay.

A civil penalty notice will set out how much the employer must pay and the date by which it must be paid. It will also include details of how an employer can object to the civil penalty notice.

A warning notice is issued with details of why the Home Office have decided not to issue a civil penalty on this occasion. This is a formal warning and will be taken into account in the event of further breaches.

A no action notice is issued if the employer is found not liable for a civil penalty and the case will be closed.

Paying the penalty

The employer must pay the civil penalty by the date specified in the civil penalty notice (unless they are objecting to the notice).

A faster payment option is available, and this reduces the penalty by 30% providing payment is made in full within 21 days. This option is only available if this is the employer’s first civil penalty, and the payment cannot be paid in instalments.

If the employer cannot make the payment in one lump sum, they can request to pay in instalments, and this is usually over a period of 24 months.

Objecting to the penalty

An employer that has received a civil penalty can object to the Home Office. They must use the objection form and file this with the Home Office within 28 days of receiving the civil penalty notice.

If a civil penalty notice is received, the employer can only object to this on the following grounds:

- They are not liable to pay the penalty (for example, they are not the employer of the illegal worker identified);

- They have a statutory excuse (i.e. they undertook a compliant right to work check); or

- The level of penalty is too high (for instance, where the Home Office have incorrectly calculated the civil penalty amount).

Where the employer has objected to the civil penalty notice, the Home Office will review the further information and documents and will issue an objection outcome notice if the penalty is to be cancelled, reduced or maintained.

If the penalty is to be increased, a new civil penalty notice will be sent.

Appealing against the penalty

An employer can challenge the civil penalty via an appeal to the County Court. The appeal must be lodged within 28 days of the date specified on the objection outcome notice, or the date specified on the new civil penalty notice.

Enforcement and other consequences of a civil penalty

If the employer fails to pay the civil penalty, the penalty may be registered with the civil court and enforcement action may be taken against the employer.

A civil penalty can impact an individual’s ability to act in the capacity of a director in a company, and we are seeing several examples of this emerge.

An employer may also be impacted from its ability to sponsor migrants if it has a sponsor licence and/or wants to apply for one in the future.

Where an employer is subject to immigration control, future immigration applications could also be impacted.

Three stage consideration process

When the Home Office consider an employer’s liability for a civil penalty and calculating the penalty amount, they will usually follow a three-stage process:

Stage 1 – Determining liability

Where an employer has been found to have employed someone with no right to work, the Home Office will check whether the employer has a statutory excuse against liability for a civil penalty.

Stage 2 – Determining the level of breach

The Home Office will check if the employer has been found to be employing illegal workers within the previous three years.

Stage 3 – Determining the penalty amount

The Home Office will assess whether this is the employer’s first breach, or a repeat breach. They will assess whether any mitigating factors apply in favour of the employer.

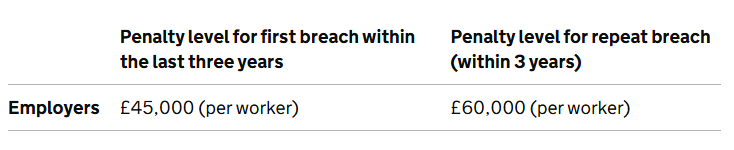

The starting point of the level of fine is as follows:

The amount payable depends on the employer’s history of compliance and if they qualify for reductions in the penalty by meeting specified mitigating factors.

Can the level of penalty be reduced?

This usually depends on whether it is the employer’s first breach, or a repeated breach.

A first breach applies where this is the first penalty, or where there have been no previous breaches leading to penalties within the previous three years. The starting point of a civil penalty notice is £45,000 per worker, reduced by £5,000 for each mitigating factor.

Mitigating factors include:

- evidence of reporting suspected illegal workers;

- evidence of active co-operation with the Home Office; and

- evidence of effective right to work checking practices.

A repeat breach applies where a previous breach leading to a penalty took place in the last three years. The starting point of any civil penalty notice here is £60,000 per worker.

Mitigating factors include:

- evidence of reporting suspected illegal workers; and

- evidence of active co-operation.

Conclusion

Employers should carry out compliant right to work checks on all individuals before any employment commences. Carrying out a compliant right to work check will give an employer a statutory excuse against a civil penalty if it turns out that the worker in question does not have the right to work in the UK.

Where an organisation holds a sponsor licence, it has an obligation to carry out compliant right to work checks in line with the Home Office guidance.

A civil penalty for illegal working can have far-reaching implications for UK employers. If a civil penalty is received, employers should seek immediate legal advice and explore the options available.

SHARE